User Question - Bank Reconciliation: bank reconciliation software

User Question

This is a list of questions from Eclipse customers who wants to use Ezyrecon.

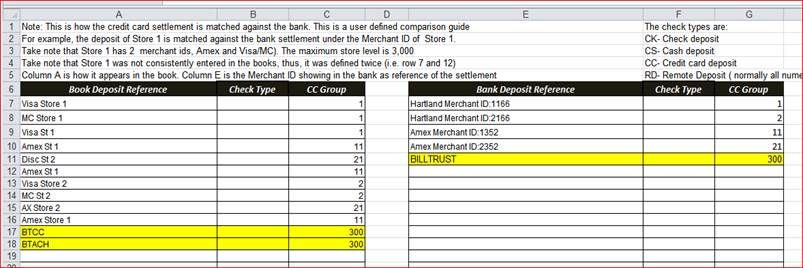

In Ezyrecon, we have this Deposit Guide where users can fill out how the system will match the deposits in the book against the bank. Attached is the sample Deposit Guide.

The objective of this Deposit Guide is to make the deposits in the books comparable to the bank as a group. Sometimes, they are not comparable as a one to one entry, but as a group, the list of entries on the books is comparable to the bank either as a group or as one entry.

The system can sum the entries on the books by the following:

· By date

· By credit card type

· By reference or customer

The maximum grouping is for 8 days. Thus, the entries in the GL from Friday, Sat and Sunday will be added together to find the match in the bank. This will consider the credit card type, the store number and payor.

If there is a delay in submitting the POS collection of credit cards, then, the system will look for it in the following 8 days, the maximum look up time. Maybe it was submitted 2 or 3 days later

The deposit guide looks like this (see picture on the bottom)

Here in this example, the collection of Visa/MC of store 1 is assigned to group 1. In the bank, the settlement coming from merchant id 8143615 for store 1 is assigned to group 1.

By doing this, we have a group 1 in the books that is comparable to group 1 in the bank. Thus, the collection of store 1 will not be compared against the collection of store 2.

ACH Matching

In some cases, the GL matches the bank exactly, in others there are multiple items in the GL that total to the bank amount. Is there a way to resolve this with the software? Will the software try and match the total in the bank to multiple transitions in the GL? How will it know?

Yes, the system can do the grouping by date ( see above)

Billtrust Matching

For our Billtrust payments, they are a guessing game for us. The total in the bank matched with items from the GL but it is multiple items and we guess using items with dates close to the bank date. The only thing we have is some key terms under the invoice column in the GL export (BTCC and BTACH) to help us know what items will correspond to the bank Billtrust deposits.

Yes, we can assign the key terms BTCC and BTACH as group 300 ( sample number) while in the bank, the Billtrust deposit will be assigned to group 300. Thus, by doing this, group 300 is comparable to group 300 in the bank.

The system will allow you to assign 3200 groupings, of your choice. Those are about 3,200 of store levels.

All Banks:

Cash Box Journal Reconciliation

How will we reconcile the cashbox if we use EZ Recon?

Also, how will EZ Recon use the report as part of their reconciliation process?

I am not clear about this question. In Ezyrecon, you can have an external report ( i.e. spreadsheet or another Excel file) outside of the Eclipse to support the breakdown of deposits.

Thus, you can make one journal entry at the end of the month in a lump sum, debiting the cash account by store level. However, the breakdown of this journal entry is supported by a spreadsheet detailing the collection per day per store, per type. We have many companies doing this. They have 31 stores, so instead of the daily entry for 31 stores; they just do one single entry for the total of the collection for the month. The journal entry in the books is supported by an external spreadsheet that they do daily to monitor the collection of the stores.

Non A/R Checks

Bank Deposit Amount has potential to be multiple checks, how will that get matched up?

At one time the deposits were made so that the bank deposit amount was the amount that appeared in the general ledger. The way we are doing things now, this does not happen because each individual check is processed separately under its own C record.

I think you are talking here about remote or deposit capture. In Eclipse there will be many rows of transaction per customer, per day. However, this deposit capture or remote deposit will show as one deposit in the bank. You can define this in the Deposit Guide that you are using deposit capture or remote deposit. Thus, the system will add those checks per day before comparing it to the remote deposit in the bank not the credit card settlement. In Eclipse, there is a customer’s check number for each collection that went through the remote or deposit capture.

Final Answer:

Yes, the Ezyrecon can do all of these. The answer lies to the correct setup of the Deposit Guide and the consistency of how the data is entered in your system. If there are deposits that we were not able to match to the bank, you can tag them manually to match to the bank. If you send us the data for July we can set it up and do the initial recon for you- the proof of the pudding is in the eating.